Understanding HS Codes and Their Relevance in International Trade

In international trade, the Harmonized System (HS) of tariff nomenclature plays a critical role in classifying goods for customs purposes. The HS Code is an internationally standardized system of names and numbers for classifying traded products. Managed by the World Customs Organization (WCO), this system helps streamline the import/export process, ensures uniformity in classification across countries, and facilitates accurate taxation and statistical analysis.

When dealing with machinery such as “coding machines” or components like “bag formers for packing machines,” understanding the correct HS Code is essential to avoid misclassification, delays, or penalties at customs checkpoints. This guide aims to provide an in-depth understanding of HS Codes, their structure, and how to determine the appropriate code for your product.

What is an HS Code?

The Harmonized System (HS) is a globally accepted classification system for traded goods. It was developed by the World Customs Organization (WCO) and is used by over 200 countries as the foundation for their customs tariffs and international trade statistics. HS Codes consist of a six-digit number that categorizes thousands of products, though countries can extend the code to include more digits for regional or national specificity.

For example, a six-digit HS Code might look like this:

- Chapter (first two digits): Identifies the product category (e.g., Chapter 84 covers machinery and mechanical appliances).

- Heading (next two digits): Further specifies the product type within the category.

- Subheading (final two digits): Provides additional detail about the product’s attributes or use.

Countries may add additional digits to create an 8-digit or 10-digit code for more detailed classifications.

What is a Coding Machine?

A coding machine is typically used in industrial and commercial settings to print or mark information on products, packaging, or labels. This information can include batch numbers, manufacturing/expiry dates, barcodes, or other product identifiers. Coding machines are vital in industries such as food packaging, pharmaceuticals, and manufacturing, where compliance with labeling standards is crucial.

Common types of coding machines include:

- Inkjet Coders: Use ink to print directly onto surfaces such as paper, plastic, or glass.

- Laser Coders: Utilize laser technology to engrave or mark codes without requiring ink or consumables.

- Thermal Transfer Printers: Employ heat to transfer ink from a ribbon onto the surface being marked.

What is a Bag Former for Packing Machines?

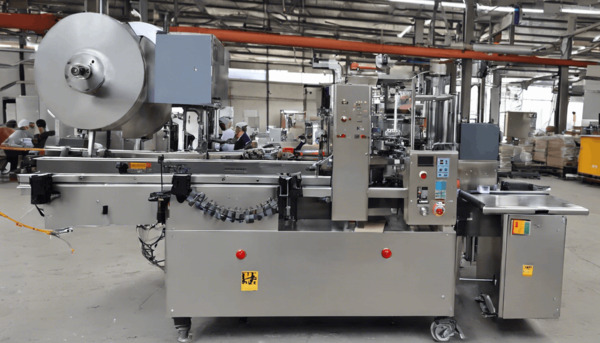

A bag former is a critical component of automated packing machines used to create pouches or bags from a roll of film. These machines are widely used in industries such as food and beverage, pharmaceuticals, and consumer goods for efficient and consistent packaging.

Bag formers guide the film into shape before sealing it to form a bag or pouch. Depending on the application, these machines can handle various materials such as polyethylene (PE), polypropylene (PP), or laminated films. Bag formers may also be part of larger systems that integrate filling, sealing, and coding functionalities.

Determining the HS Code for Coding Machines and Bag Formers

To determine the HS Code for specific products such as coding machines or bag formers for packing machines, one must analyze their functionality, components, and use cases. Here’s how you can identify the relevant HS Code:

Step 1: Identify the Product’s Category

Coding machines typically fall under Chapter 84 of the HS Code system, which covers “Machinery and Mechanical Appliances.” Specific headings within this chapter relate to printing machinery or equipment used for marking products.

Similarly, bag formers are part of automated packing machinery and are also classified under Chapter 84, specifically under headings related to packaging or wrapping equipment.

Step 2: Review Relevant Headings

For coding machines, the relevant headings may include:

- 8443: Printing machinery used for printing by means of plates, cylinders, and other printing components; parts thereof.

- 8479: Machines and mechanical appliances with individual functions not specified elsewhere.

For bag formers used in packing machines, consider headings like:

- 8422: Machinery for cleaning or drying bottles or other containers; machinery for filling, closing, sealing, or labeling containers; machinery for aerating beverages.

- This heading also covers “packaging machinery,” which includes components like bag formers.

Step 3: Consult National Customs Authorities

While the six-digit HS Code is standardized globally, additional digits may vary by country. To ensure accuracy, consult your country’s customs authority or an experienced customs broker who can confirm the specific code based on your product’s description.

Sample HS Codes for Reference

Below are some sample HS Codes relevant to coding machines and bag formers:

- Coding Machines:

- 8443.39: Other printers, copying machines, and facsimile machines (including parts and accessories).

- 8479.89: Other machines and mechanical appliances having individual functions not specified elsewhere.

- Bag Formers for Packing Machines:

- 8422.30: Machinery for filling, closing, sealing, or labeling containers; machinery for packing or wrapping goods.

- 8422.40: Parts of packing or wrapping machinery (including bag formers).

Importance of Accurate HS Code Classification

Accurate classification of goods under the correct HS Code ensures smooth customs clearance, reduces delays, and prevents disputes over incorrect duties or taxes. Misclassification can lead to penalties or even seizure of goods in extreme cases.

To avoid errors when classifying products like coding machines or bag formers:

- Provide detailed descriptions of your product’s functionality and composition when consulting customs authorities or brokers.

- Regularly update your knowledge of changes to HS Codes since revisions occur every five years.

- Utilize tools like online tariff databases provided by customs authorities in your country.

Conclusion

Determining the correct HS Code for products such as coding machines or bag formers for packing machines requires a clear understanding of their functionalities and applications. By referring to Chapter 84 of the Harmonized System and consulting with local customs authorities when necessary, businesses can ensure accurate classification and compliance with international trade regulations.

If you are still unsure about the appropriate HS Code for your product after reviewing this guide, it is recommended that you seek professional assistance from a customs broker or trade compliance expert to avoid costly errors during import/export operations.